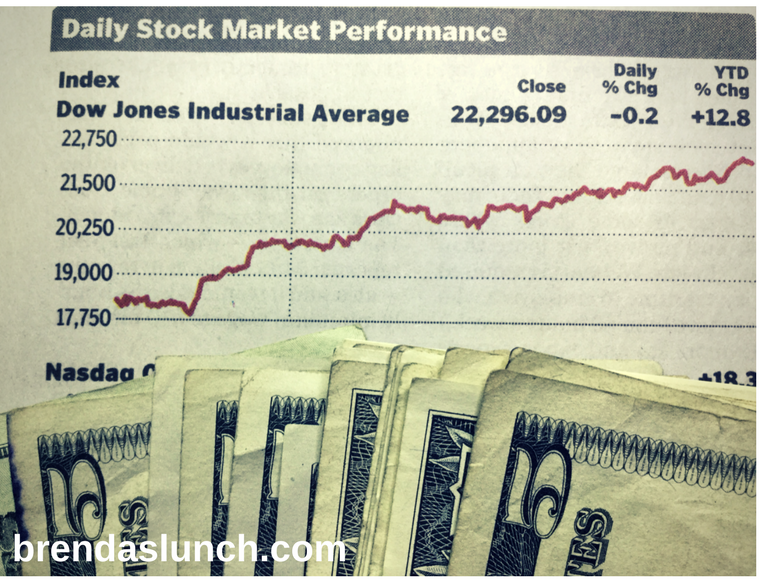

Is This a Good Time to Invest?

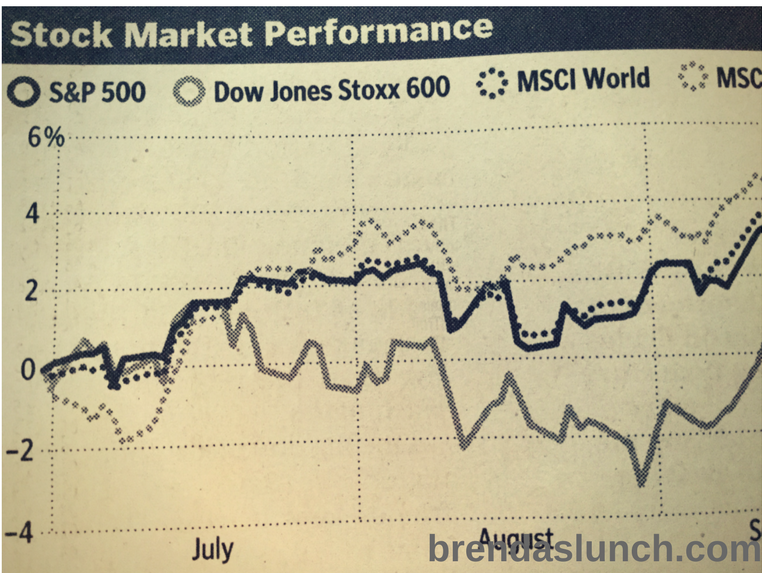

The U.S.A. stock market is at all-time highs, so you may wonder if this is a good time to invest … Even with new records being set on a regular basis, there is always an opportunity to invest. If you use the concept of “dollar cost averaging,” you buy fewer shares of stock when the stock market is high, and more shares of stock when the market is low.

What is Dollar Cost Averaging?

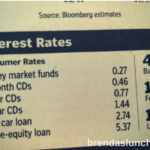

Dollar cost averaging is investing a fixed amount of money on a regular basis over a period of time, preferably a long period of time. For instance, you can set aside $50 per month to invest in a conservative mutual fund. No matter what is happening in the stock market on a daily basis, you continue to invest $50 per month in the mutual fund. The mutual fund is invested in individual stocks, bonds, Certificates of Deposits, etc. To learn specifically what the mutual fund invests in, check the prospectus. The prospectus will also show the returns investors receive over time (year-to-date, 1 year, 2 years, 3 years, 5 years, 10 years, since inception).

How to Learn More?

To learn more about the concept of dollar cost averaging, click here. To learn more about stocks, click here. For more on mutual funds, click here.

The opinions expressed herein are solely those of the Author/WebMaster. Before taking any action, please consult your real estate, financial, and legal advisors.

![Federal Reserve [Photo Courtesy: Wikimedia Commons]](http://brendaslunch.com/wp-content/uploads/2017/07/brnds_Federal_Reserve.jpg)