Short-Term Savings

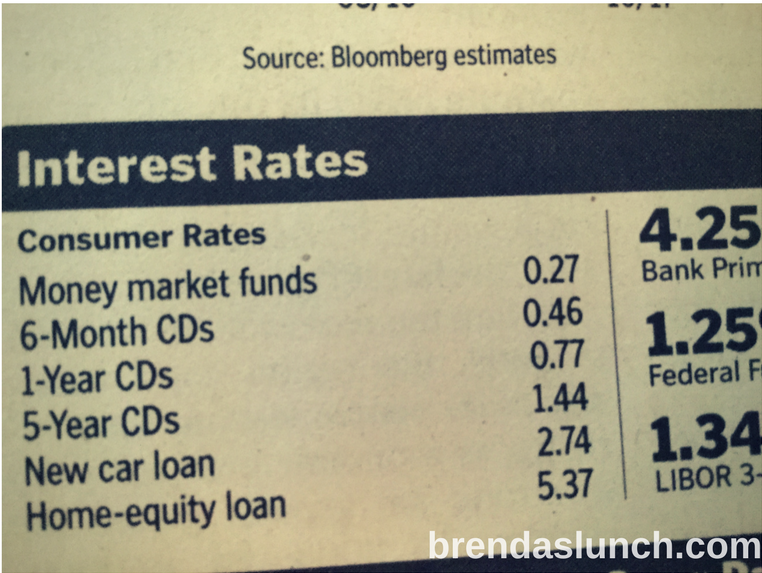

Does your money go to work for you everyday, or does it stay at home and relax while you are at work??? If your money is sitting in a savings or checking account at a bank, it is earning less than 1% per year in interest. It’s fine to keep money for your daily expenses and monthly bills in a checking account, but money for mid-term savings, long-term savings and emergency funds should earn more than 1%. At the bare minimum, savings and emergency funds should be invested in a money market account. For a list of the best money market accounts, click here.

Mid-Term Savings

If you are saving to buy a car or a down payment for a house, you don’t want to risk losing your principal. For mid-term savings, it may take 2 – 5 years to save for a car or down payment. Since you cannot afford to lose principal, and would like a return larger than 1% annually, certificates of deposit (CD) might suffice. For example, a 1-year CD at Ally Bank pays 1.65% per year. A 2-year CD at SECU Credit Union pays 1.85% per year. A 3-year CD at Goldman Sachs Bank USA pays 2.00% per year. Rates are starting to gradually increase, so be careful about committing to too long a term. For the best CD rates in the USA, click here. Compare a 1.65% CD to a .5% savings or checking account … you have literally tripled your return! Make your money go to work for you!

Long-Term Savings

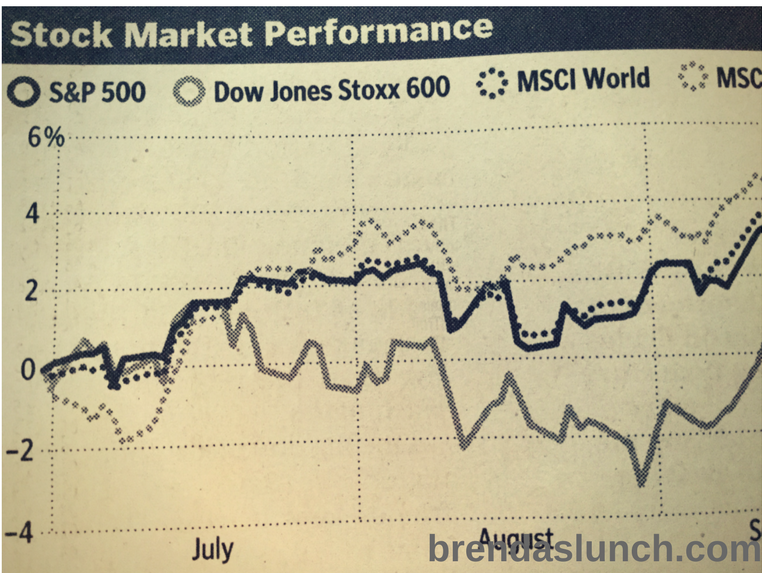

Saving for long term goals like college tuition or retirement allows you to take more risks because you are saving for a goal that is more than 10 years away. Since you have time to weather the ups and downs of the market, you can invest in stocks, bonds and/or mutual funds. An excellent resource to find mutual funds in synch with your goals, visit Morningstar. For the 10 best mutual funds for retirement, click here. Over the long-term, stocks return approximately 10% per year. When evaluating mutual funds, use stocks’ historical returns as a measuring stick. The mutual fund prospectus will show performance statistics. In my opinion, mutual funds are the best investment for long-term goals such as college tuition and retirement. If you are disciplined and use dollar cost averaging to invest every month in a good mutual fund, your money will go to work for you while you relax at home in retirement!

The opinions expressed herein are solely those of the Author/WebMaster. Before taking any action, please consult your real estate, financial, and legal advisors.