The Tax Cuts and Jobs Act of 2017 has passed the House of Representatives and the Senate. As with any tax bill, there are winners and losers. In this case, pass-through companies are the winners.What moves can we make to benefit from the Tax Cuts and Jobs Act of 2017?

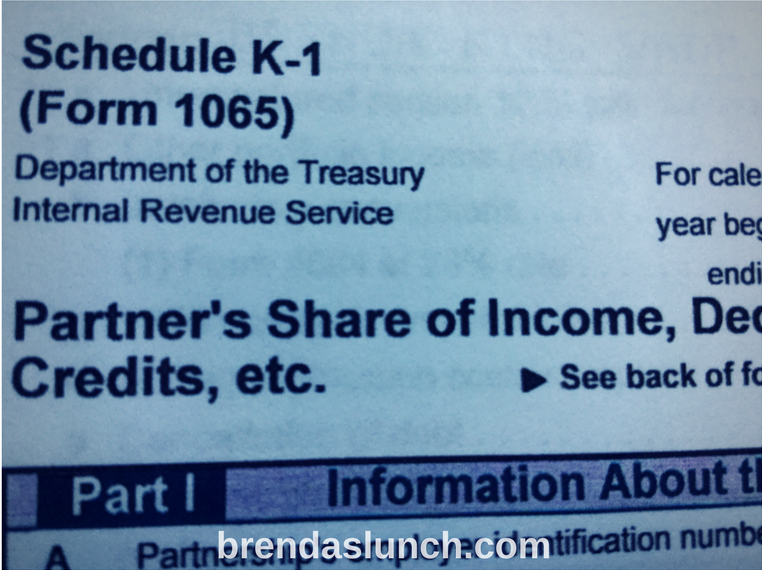

- The very first thing each American taxpayer must do is figure out what is a pass-through?

- The second thing every American taxpayer must do is find a good accountant or enrolled agent!

- The third thing every American adult or teenager must do is start a business. American businesses, large, medium, and small, are huge winners of the tax reform law.

- Do everything you can to learn more about the U.S. Tax Code. Visit the IRS website for tax forms, schedules, and instructions.

- Invest in the American financial markets. Why? The Tax Cuts and Jobs Act benefits American corporations more than anyone else! If corporate earnings increase, stock prices should also increase. To learn how to get started, click here.

Bonus: To learn the new tax brackets and rates, click here.

The opinions expressed herein are solely those of the Author/WebMaster. Before taking any action, please consult your real estate, financial, and legal advisors.