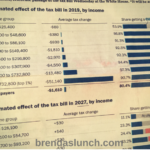

The Tax Cuts and Jobs Act of 2017 has been signed by the President of the United States. As with any tax bill, there are winners and losers. In this case, pass-through companies are the winners. The very first thing each American taxpayer must do is figure out what is a pass-through? The second thing every American taxpayer must do is find a good accountant or enrolled agent! The third thing every American adult or teenager must do is start a business. American businesses, large, medium, and small, are huge winners of the tax reform law. The sweetener in the tax cuts law is that only 80% of pass-through business income is taxed. Twenty percent of pass-through business income is TAX FREE!

Bonus: To learn the new tax brackets and rates, click here.

The opinions expressed herein are solely those of the Author/WebMaster. Before taking any action, please consult your real estate, financial, and legal advisors.